How should you invest after retirement?

Traditionally, investors have been told that when saving for their retirement there is a standard path to follow. In the early years, when they are younger and many years from the end of their working lives, they can afford to take more risk and maximise their exposure to stocks. As they near retirement, however, they should become progressively more conservative with their money, moving from shares into cash and bonds.

After retirement, the most important thing becomes preserving capital. Investors should therefore be cautious with their savings so that their money is secure.

However, at a time when few people are able to retire comfortably, it is worth asking whether that model still makes sense. Are the traditional ways of thinking about investing after retirement still relevant?

Putting numbers to it

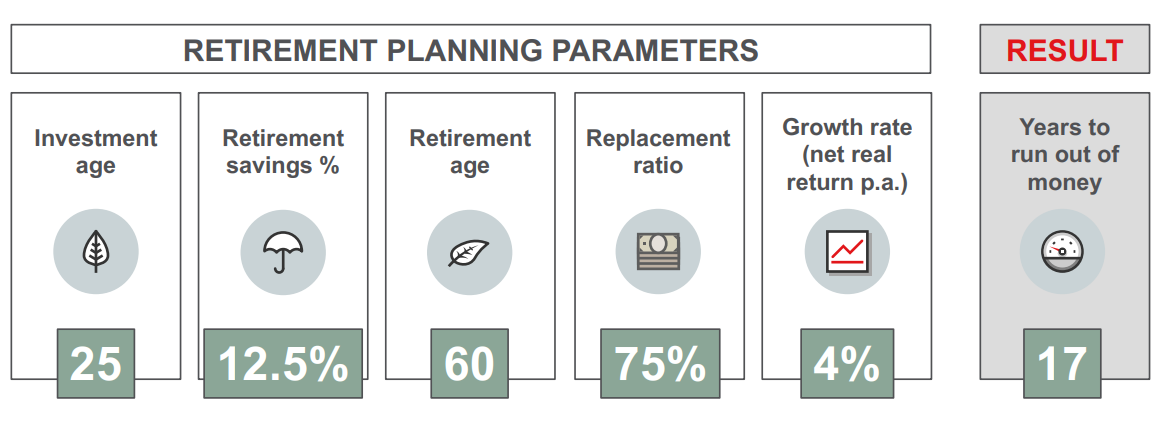

Consider someone who starts working at the age of 25. They put away 12.5% of their salary – the current average in South Africa – and work until the age of 60. After retirement, they draw an income from what they have saved that is equal to 75% of their final salary.

If you assume that this individual earns a return of 4% above inflation on their money through this entire journey, after all costs, their money is only going to last for 17 years. By the age of 77, their capital will be gone.

For Pieter Hugo, MD of Prudential Unit Trusts, that is a “fairly problematic” result. If that is what the average South African faces in retirement, then it’s clear that there is a significant problem.

As he points out, however, there are different ‘levers’ that an investor can pull to make that outcome better.

For a start, if they begin saving five years earlier, their money will last eight years longer.

Similarly, retiring five years later would also deliver an additional eight years of income. Since they would also only retire at 65, this would mean that their savings would last until the age of 90.

If they save more, that has a particularly notable effect. Putting away 18% of their salary instead of 12.5% would add 14 years.

The importance of the return

Finally, if they earned 6% above inflation for their whole lives instead of 4%, their money would never run out. That is quite an aggressive assumption however. South African equities have returned 7% above inflation over the last 100 years, but few people would be, or even should be, 100% invested in the stock market all the time.

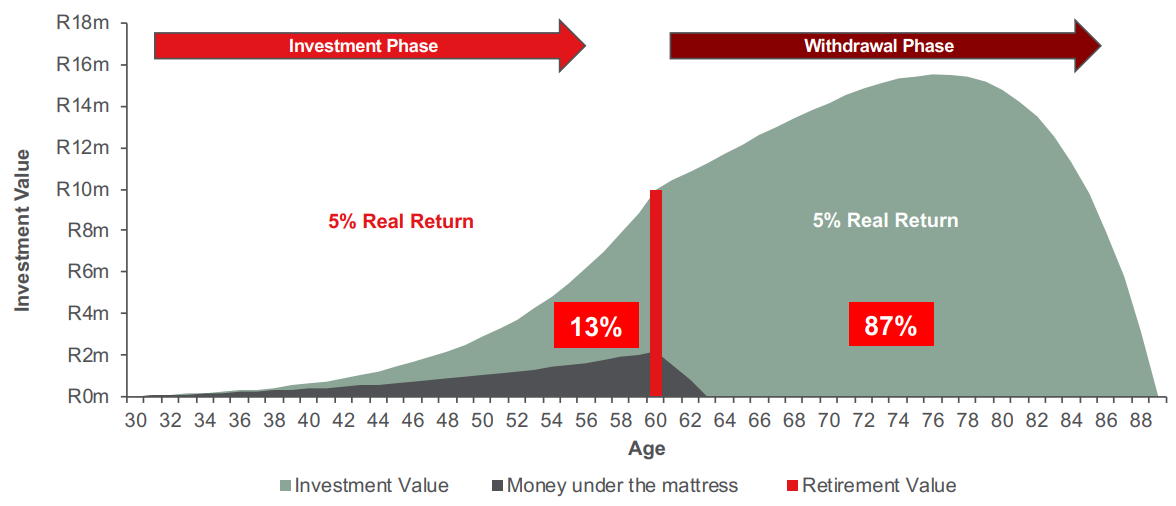

What is particularly noteworthy for Hugo, however, is when those returns are generated. Assuming an investor earns 5% above inflation for their whole lives, this is what their journey looks like:

“If these are all the investment returns earned throughout your entire life, 87% is earned after retirement,” says Hugo. “That is quite scary and we need to think about it quite a bit, because when many clients, at age 60, come with their pot of money to an advisor, they say please help me to invest this money. It needs to last for the rest of my life, so can we please invest it conservatively. I don’t want to see volatility, and I don’t want to see it go down.”

This is an understandable approach. However, if the majority of your investment return needs to be earned post-retirement, you can’t afford to move away from growth assets. You still need to be exposed to the best generator of growth, which is the stock market.

The risk that matters

For Hugo, the concern is that many investors don’t do this because they are focusing on the wrong risk.

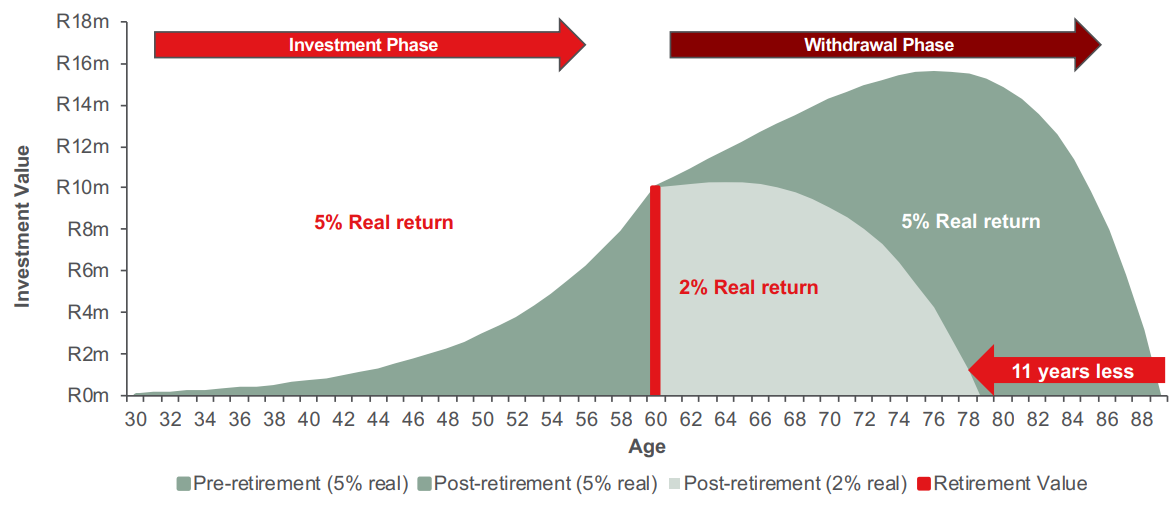

“At age 60, many investors don’t want to take on growth assets like equities that will get them inflation plus 5%,” says Hugo. “But if you invest at inflation plus 2%, you lose 11 years’ worth of income. That is the cost of investing conservatively.”

That doesn’t mean there isn’t a need to be prudent with your money in retirement. Particularly because a large drop in the stock market in the early stages can have a material impact on your retirement as a whole, it is worth considering separating your capital into two parts – a conservative investment that can fund your income needs over the next few years, and a more aggressive investment that can generate long-term inflation-beating returns.

If you have all your money in more stable assets like cash and bonds, however, the outlook for your capital is always going to be worse.

“I want to challenge conventional thinking,” says Hugo. “If you invest for retirement, that is a 70-year affair. And what is going to happen if you put a significant chunk of your retirement pot into cash and bonds? You are going to run out of money before you die. In my mind, that is a lot scarier than volatility.”

https://www.moneyweb.co.za/mymoney/how-should-you-invest-after-retirement/